Forex Trading Scams

Are you a victim of a Forex trading scam? Are you worried about losing your hard-earned money to fraudulent trading schemes? Have you discovered a forex trading platform with amazing trading options, a free demo account and lucrative financial assets, but it seems too good to be true?!

The forex market is a highly lucrative and fast-paced industry, but it is also a breeding ground for scams. These money-grabbing cons come in various forms, from fake trading software to Ponzi schemes, and they can leave victims in financial and psychological ruin.

For this reason, individual traders have to educate themselves on the dangers of forex trading scams to protect their finances. By understanding the warning signs, you can perform your due diligence and discern legitimate opportunities for actual profits from forex scams.

Keep reading our article to learn how to avoid forex scams and enable yourself the chance to trade forex safely. Together, we can put a stop to these fraudulent schemes and protect investors from forex trading scams.

Is Forex Trading Legitimate?

The Foreign Exchange Market, commonly known as Forex, facilitates a perfectly legitimate form of day trading. It is a decentralized and international financial market where currencies from different countries are traded against each other, thus enabling all participants to buy and sell currency pairs for profit.

These trading systems are practiced regularly by large financial institutions like banks but also by private individuals alike. To prove how popular this form of trading is, just note that forex is the largest financial market in the world. On top of it, it is also the most liquid market, with an average daily trading volume of over $5 trillion.

The main appeal of forex trading is that it allows investors to profit from fluctuations in currency prices, and it can be done anywhere in the world. You just need a computer with an Internet connection. It also offers a high level of liquidity, which means that trades can be executed quickly and at tight spreads. Additionally, all of this is available instantly! Investors don’t need to own stocks or commodities. They can start trading without much fuss.

Enter Forex Market With the Right Mindframe

Sadly, the fact of the matter is fraudulent organizations exploit all of these benefits to trick people into giving away their hard-earned money. The forex market is open to anyone, but this means it’s also open to fraud. Don’t worry, our article can help you avoid forex trading scams.

Any novice trader should take this to heart – Forex trading is not easy money, though scammers would like people to believe this. True, it can be highly profitable, but it also carries significant risk. Losing trades are common, while successful trades take up only 10% of the entire trading practice.

One should keep in mind that profitable trading requires financial knowledge, skill, great foresight, and even a bit of luck. Traders need to analyze news, financial trends, world market trends, and how they influence foreign currencies.

On the other hand, fraudsters will make forex look like easy money. They will promote amazing exchange rates and interest rates, huge profits, incredible returns on the initial investment, forex robots who trade for you, and the list goes on. We will cover the main points of common forex scams in greater detail further in the article.

What Are Forex Scams?

Simply put, forex scams refer to fraudulent schemes that prey on unsuspecting traders in the foreign exchange market. These cons come in various forms, including fake trading sites, fraudulent brokers, and even Ponzi schemes. The common factor, though, is that all of these scams promise high returns on investments with little to no risk.

Generally speaking, forex scams lure and manipulate traders into investing with unregulated or unscrupulous brokers. These organizations or individuals may promise unrealistic ROI or offer trading signals and software that are too good to be true. Sadly, traders succumb to manipulative tactics and consequently transfer money to crooks. Once the trader gives away their funds, the broker disappears with it.

Typical Forex Scam Case

Though each fraud case is individual, and victims can often find themselves in unique situations, the fact of the matter is that scammers operate on well-tried tricks and scenarios. Recognizing the mechanisms of the scheme may be the key to avoiding it, and so we’ll present you with the typical case of a forex scam. Be warned that specific situations, conditions of fraud, or your own experience may differ.

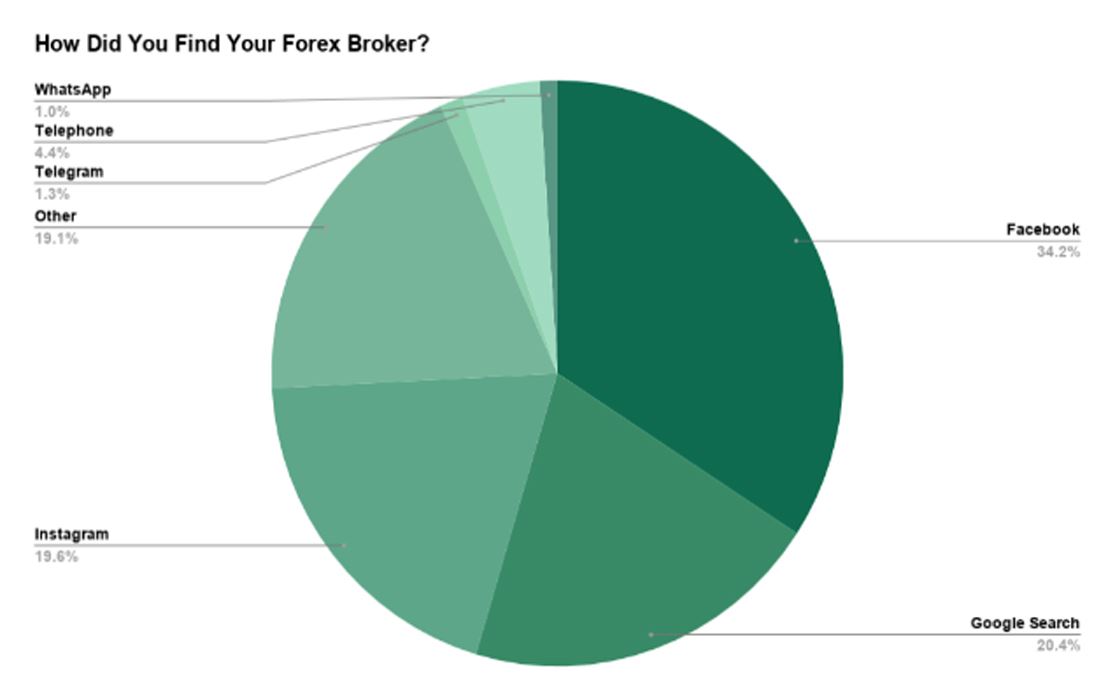

One should understand that scams influence targets much before they come in contact with them. Primarily, fraudsters create fake social media profiles, set up fraudulent trading systems, and sometimes invest in aggressive marketing across the internet. They utilize these assets to practice social engineering and create a false image of being legitimate forex companies. When eventually, someone finds the site or fake social media profile, it looks genuine and reputable.

Regardless of the form the forex scam takes, it dominantly entices its victims with the dazzling promise of an unbelievably large return on investment with a 100% guarantee. Basically, They promote instant vast wealth with no risk whatsoever. They support these claims by feigning financial expertise, state-of-the-art forex robots, insider information, and so on.

At first, the individual experiences small profits, and they might even be able to collect them. This is all for the purpose of reinforcing the insidious illusion that the forex scam is actually working. The victim believes the broker generates wealth, and so they are encouraged to invest larger and larger amounts. However, the moment the person tries to withdraw their money, they realize they can’t. They are met with withdrawal fees and transaction costs, but ultimately they realize their money is gone.

Why Do People Fall For Forex Scams?

The success of most forex scams lies in the exploitation of simple truth – almost everybody wants or needs money. Whether this is motivated by simple greed or because the individual is in a dire financial situation is irrelevant. Scammers abuse this, and they lie about how they can provide easy and quick riches. Many novice forex traders are drawn in by the promise of high returns with little risk, while some people reach for unregulated brokers because they need a steady stream of income.

Forex scams are particularly effective because they use social engineering, false marketing, and exploitative narratives to trap and control their unsuspecting targets. Fraudsters are masters of pressure tactics, emotional manipulation, and FOMO – the fear of missing out.

It’s also important to note that everyone can fall for forex scams. People have a false impression that only gullible and greedy people can get scammed. The truth is, fraudsters use every trick possible to swindle people, and it’s just a question if they find the right tactic for the specific individual.

Most Common Types of Forex Scams

Since forex scams come in various forms, it’s important to be aware of the most common types in order to protect yourself from falling victim to one. In this section, we will take a closer look at the most prevalent versions of forex fraud. Hopefully, with our article, you will be able to spot forex scams easily.

Nevertheless, be warned: scammers are continuously improving their schemes and inventing new ones so they could take advantage of unsuspecting traders. This means you should always take extra caution when searching for the right regulated broker.

Scam Forex Brokers

Out of all forex scams, fraudulent brokers are the most frequent and widespread. These brokers usually take the form of trading sites that emulate the design of legitimate platforms, and also they copy content from reputable sources. Eventually, when a victim visits the site, they believe it’s a genuine financial services agency.

Nowadays, scam brokers rarely deal solely with forex. In order to cast a wider net, they also promote other types of trading. Quite often, a single unregulated broker is commonly a forex fraud, binary options scam, and trading CFDs scheme in one. These scam brokers can also appear as fake social media profiles, thieving forex influencers, and mobile apps. An individual crook may also pose as a licensed financial advisor and contact victims directly via email or phone.

Instagram Forex Scams

Recently, Instagram has become a breeding ground for trading scams. Forex fraudsters set up fake profiles presenting themselves as forex experts with a business background. They flaunt fake credentials, and they fill profiles with photos of trading charts, hefty dollar bundles, luxurious destinations, cars, vapid motivational quotes, and so on. Additionally, they create a large following of bot profiles and leave positive comments so the unsuspecting victim would fall for their lies.

They contact people through social media platforms, promising them exceptional and quick returns on their investment. These scammers typically use persuasive language and high-pressure tactics to convince individuals to invest their money. They give precise instructions and basically coerce the victim into giving away their money. Like many scams, the target has the illusion of gaining profit. However, the moment the victim tries to withdraw their forex fund, the swindler deletes the profile and disappears without a trace.

It’s important to note that these types of scams also target people on other social media platforms like Facebook, Youtube, LinkedIn, and even chat apps like Whatsapp.

What is the procedure for returning Money?

You can easily start your road to financial justice by simply leaving your contact information on our site, and you will receive a free consultation. Should our case coordinators evaluate your case has a strong chance of success, only then, timesharerecoveryservices.com will accept it.

Afterward, case agents perform a thorough investigation and collect evidence to back your case. Along the way, we evaluate official financial bodies which are liable and which showed gross negligence and so contributed to the fraud. Then we dispute your charges and bank transfers with these institutions to ensure you regain lost funds. Don’t hesitate and contact us to schedule your free consultation.